Younger customers report better customer service experiences – so why are they less loyal?

)

For its latest report, “Exceeding UK Customer Expectations”, ContactBabel commissioned a survey of 1,000 UK consumers to look at what they most valued when contacting a business, what they actually received and then if they did anything about it.

The report shows that while there are some common factors that different types of customer value – first-contact resolution and a short queue time stand out – there are significant differences in what older and younger customer demographics look for, as well as their loyalty (or otherwise) to the business.

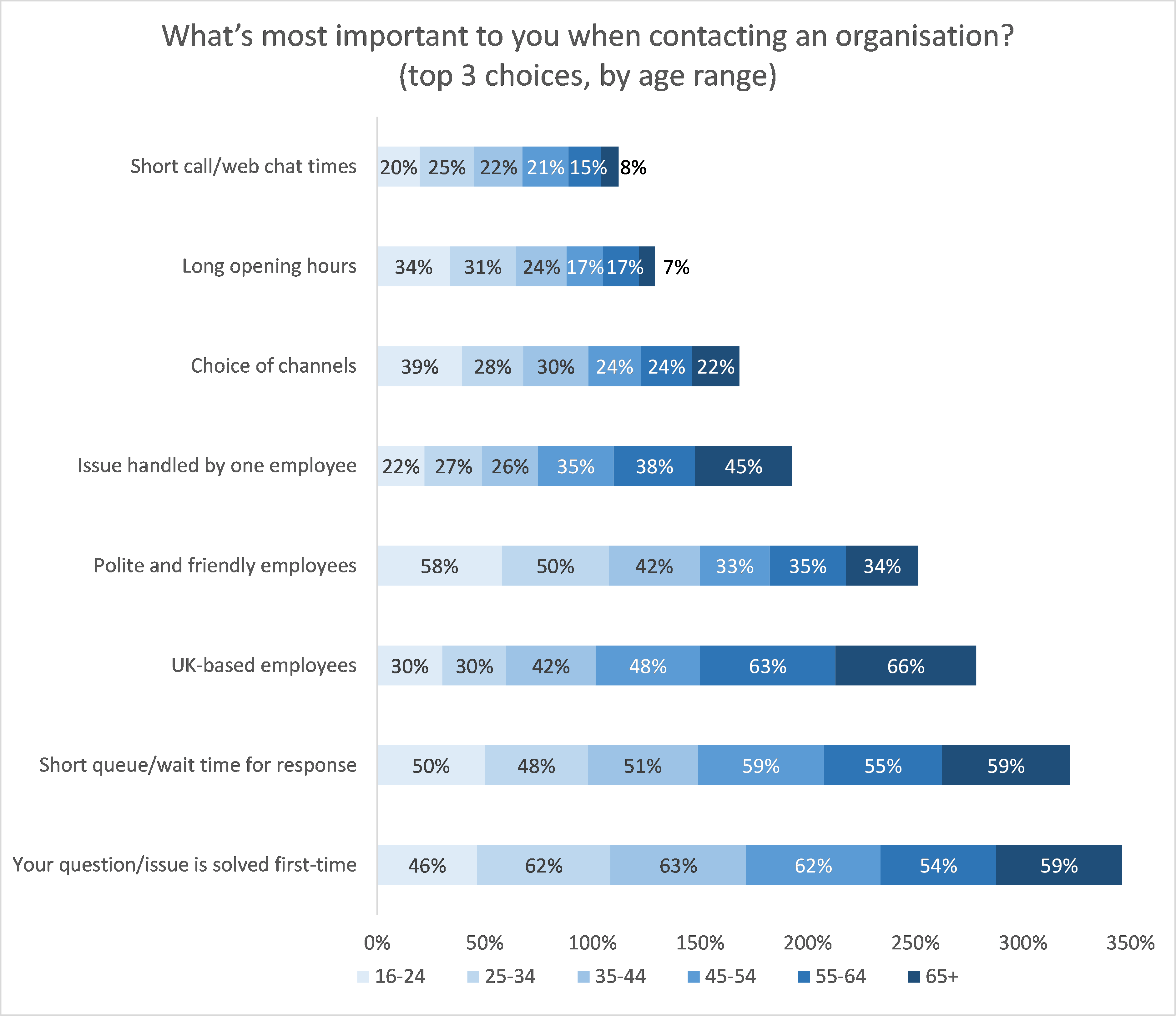

Survey respondents were provided with a list of eight factors that affect customer experience and asked to rank them in order.

This chart shows the top 3 customer experience factors as an aggregated bar chart, segmented by age so as to show the factors that were of most importance to customers in each age range. Aggregating the results allows an understanding of which factors were placed in the top three overall, while also providing insight on age-related opinion.

Figure 2: What’s most important to you when contacting an organisation? (top 3 choices, by age range)

Younger respondents seem to place a greater value on their time than older people, being far more likely to rate short call / chat times and long opening hours as being valuable.

Younger people also rate having polite and friendly agents as the most important factor impacting CX, being even higher than a short queue time or first-contact resolution. This may be because the youngest age group have the least experience of dealing with businesses and contact centres, perhaps lacking some of the confidence that comes with years of speaking with businesses, and to have a friendly and approachable agent is valued very highly.

Younger age groups are also much more likely to value a choice of channels and long opening hours, the latter of which can be achieved through effective self-service options which younger customers are generally willing to try out.

One of the most noticeable differences between ages groups is the requirement for UK-based employees, which is very important for older customers, but much less so for younger people.

Older customers are also very focused on first-contact resolution – they do not wish to have to call back – and also want their issue handled by a single employee. They are also more likely to value a short queue time.

It must be emphasised that unless a business deals almost entirely with older or younger customers, that all of these factors are valued highly by a substantial part of their customer base, and need to be addressed.

The report also looks at how customer age groups rate the service they actually receive from seven types of company.

Looking into the data by age group generates some interesting findings, with younger customers generally more likely to rate companies positively:

- Bank / credit card providers: 71% of under-35-year-olds were positive (i.e. rated service as excellent or good), compared to only 56% of those 35-65. It may be the case that this is an impact of the younger generation being far more likely to do most of their banking on an app, which often now allows them to communicate in real time with the business without having to call the contact centre.

- Insurance: younger age groups were more likely to be positive about this sector, with 54% of under-35s being positive compared to 40% of over-35s.

- Internet / TV providers: the pattern is repeated again: 58% of under-35s are positive, with only 40% of over-45s feeling the same way.

- Utilities: only 35% of 35-65 year-olds are positive about utilities customer experience, against 54% of the youngest group, who perhaps are far less likely to be contacting these types of company regularly.

- Telecoms (fixed-line and mobile): the level of satisfaction is lower in the middle age groups. 34% of 35-65 year-olds are positive, compared to 58% of under-35s and 54% of over-65s.

- Retail: younger customers were more likely to be positive, with 57% of <35-year-olds reporting excellent or good customer service, compared to 44% of >55s.

- Transport & Travel: 18% of the customers surveyed ruled themselves out of answering this question as they had not contacted a travel company in the past 12 months, with this much more the case for older survey respondents. Of those that gave a rating, 60% of under-35s gave a positive rating, but only 32% of over-55s did the same.

There seems to be a definite pattern that younger customers are more satisfied generally with the level of service that they receive from organisations.

While the survey doesn’t look into why this is (and without detailed individual face-to-face interviews, it would be difficult to find this out), there are various possibilities if we rule out the extremely unlikely explanation that companies actually provide a different level of service to customers depending on their age:

- Expectations of what constitutes good customer service are lower in younger age groups. This may be driven by the customers’ past experience of customer service: those with both higher incomes and more life experience are more likely to have experienced exceptional levels of service in the past (e.g. in high-end restaurants, onboard cruise ships or on first-class flights) and this has raised their internal benchmark of what customer service should be

- There are theories that self-esteem differs by socioeconomic group and age: do certain cohorts feel that they deserve top-quality service because of who they are, and are they more critical as a result when it does not live up to their expectations? There is some scientific evidence to suggest this may be the case[1]: higher socioeconomic groups report higher self-esteem, as do older age groups

- The quality of service across channels may in fact different, and as various age groups prefer to use one channel over another, their customer experience with the same company is in fact different. There is some evidence that this is the case: overall, younger customers do prefer to use digital channels and older customers will choose telephony or face-to-face communication more often. Potential CX issues such as long phone queues, UK-based employees, long IVR menus and poor audio quality are clearly linked to telephony rather than digital channels, and removing these from the customer experience should impact positively, perhaps explaining the gap in customer satisfaction across age groups.

However as the report shows, there is no guarantee that the younger age groups’ more positive views on customer service translate to loyalty, and we should remember that telephony provides an inimitable opportunity to lock in customers through truly memorable positive customer experiences.

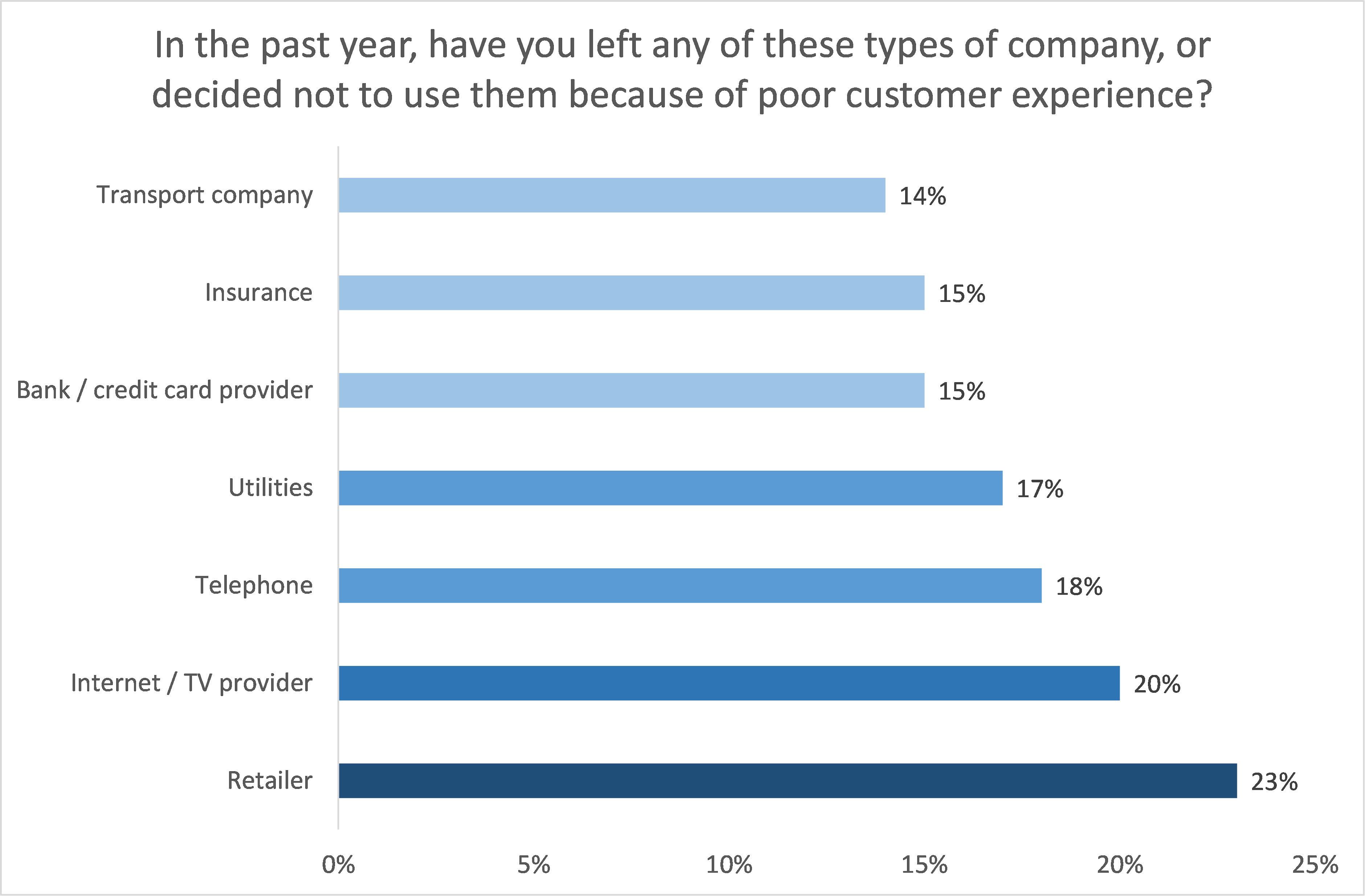

Customers were asked if, in the past 12 months, they had left any of the seven types of company listed or had used a competitor instead because of poor customer experience.

As the following chart shows, a very significant proportion of respondents stated that they had in fact done so.

Figure 20: In the past year, have you left any of these types of company, or decided not to use them because of poor customer experience?

While these figures are alarmingly high, it should be noted that a “poor customer experience” can be construed in many different ways.

While the examples given in the survey question included long phone queues; not being able to answer a question; being passed around numerous employees; and experiencing rudeness from staff, it deliberately did not state that those were the only examples of a poor customer experience. For many customers, especially younger ones, their customer experience is in large part driven by their interactions with the website, app or digital support channels.

The pattern is very obvious – even when taking into account the increased margin of error that working with smaller datasets at an age-group level creates – the younger the customer or prospect, the more likely they are to have reported changing supplier or using a competitor because of poor customer experience.

Again, without asking each individual survey respondent about their personal experience, there is no way of finding out exactly why there is such a difference between age groups, but some suggestions can be made:

- The propensity to switch supplier gets less as customers become older. Switching becomes extremely unlikely in the most senior reaches of oldest age group (80+ years-old), and for vulnerable people (many of whom are in the 65+ age group), with government findings backing this up in the utilities sector.[1] Of course, switching is not always down to poor customer experience, with cost being a more important factor in the energy sector, but the willingness or otherwise to look for other suppliers could be age-related to some extent

- Those customers who have changed suppliers in the past are more likely to change suppliers in the future[2]: brand loyalty amongst Generation Z is much lower than for other age groups[3] and the effect on this cohort of digital customer experience is higher[4], meaning that businesses need to see their website as being the primary source of customer experience for younger customers

- However, the focus and preference of younger customers for digital channels (including self-service) means that there is less opportunity for an exceptional personalised customer experience to take place – for example, in the telephony channel or in a shop – which could support long-term customer loyalty

- Older people who have been customers in the times before the Internet when switching companies was not simple or cheap may be influenced by the familiarity effect of brands that they have been with for a long time, and be less influenced to switch suppliers by poor customer experiences: they see themselves as a “Brand-X” customer regardless, and this can even become part of their self-identity.

This could go some way to explaining why older customers are more likely to rate their customer service experiences lower than younger cohorts, yet are far less likely to have done anything about it.

Businesses considering making investments in customer-facing technologies should be very wary of putting all of their eggs in the self-service basket: telephony is still seen by customers as the gold standard of customer service.

Investments in making the phone channel quicker and more effective could well pay dividends in long-term loyalty and advocacy.

[1] https://www.gov.uk/government/publications/consumer-vulnerability-challenges-and-potential-solutions/consumer-vulnerability-challenges-and-potential-solutions

[2] https://www.eprg.group.cam.ac.uk/wp-content/uploads/2015/09/1515-PDF.pdf

[3] https://cxm.co.uk/disloyal-brands-failing-to-attract-younger-customers-to-loyalty-schemes/

[4] https://martech.org/51-of-consumers-would-leave-a-brand-if-digital-experience-isnt-as-good-as-in-person/#:~:text=Younger%20consumers%20are%20less%20loyal,according%20to%20the%20PwC%20findings.

[1] https://www.eprg.group.cam.ac.uk/wp-content/uploads/2015/09/1515-PDF.pdf

[1] https://cxm.co.uk/disloyal-brands-failing-to-attract-younger-customers-to-loyalty-schemes/

-(1650-×-500px)-(2).png)